Market Review & Outlook

Market Review

January 2026

Another eventful quarter completed what was a quite extraordinary but ultimately a very productive year for investment markets.

Global investment markets showed remarkable resilience in 2025 despite regular challenging headlines around issues like significantly higher US trade tariffs, geopolitical tensions, and concerns over government debt levels in a number of countries.

The new US administration was certainly very active in 2025, and it was President Trump’s varying policy announcements on tariffs that had the most impact on markets. The initial sell-off following the unexpectedly high April ‘Liberation Day’ tariff levels reversed as investors welcomed progress in trade deals and evidence that higher tariffs to date were having a more limited impact than initially feared.

However, the key to the strength of markets in 2025 was the ongoing backdrop of solid global economic and corporate growth, inflation largely under control, declining interest rates and fiscal stimulus, with added impetus relating to the rapid development and potential of artificial intelligence.

Lower interest rates are supportive for most asset classes, and the progress on subduing inflation enabled most central banks to deliver a series of cuts in 2025. Whilst the US was slower to reduce rates than Europe and the UK, their cuts beginning in September provided a boost to investor sentiment. December also saw a further 0.25% rate cut in the UK, taking the bank rate to 3.75%, which was a full 1% reduction since the start of 2025.

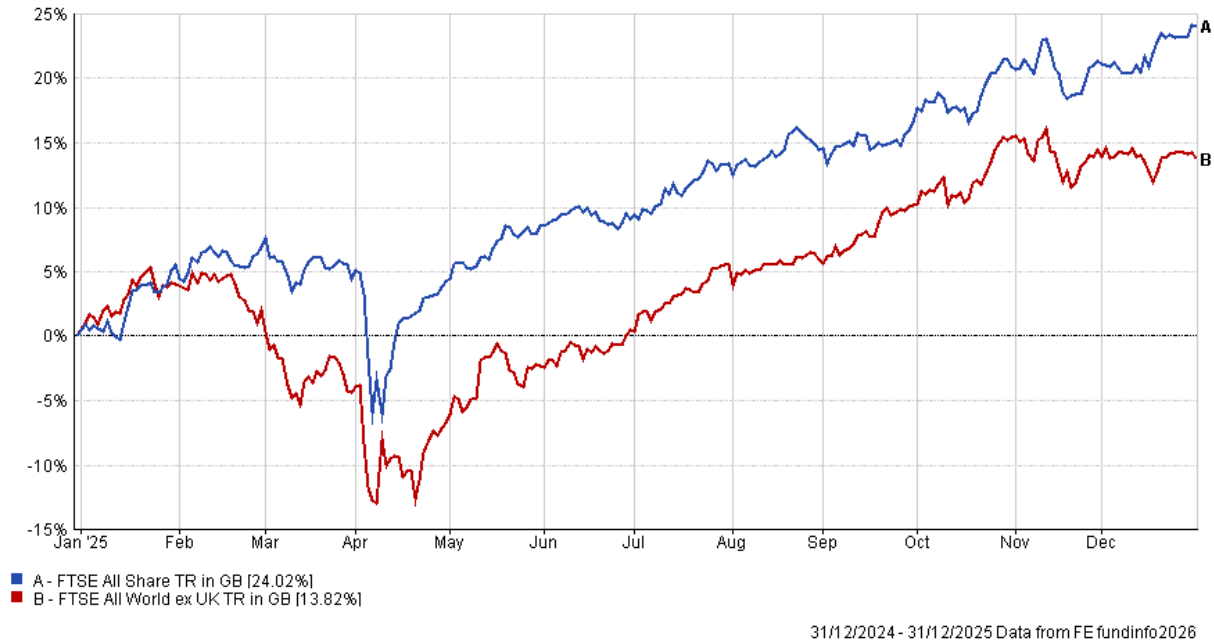

Further gains in the final quarter completed a strong year for equities, with 2025 seeing a welcome broadening out of equity market leadership outside of the previous US dominance. Within international equities, the overall index gained 13.8% in sterling terms for the year, with Asia Pacific ex-Japan and Europe seeing the strongest returns, whilst US dollar weakness helped cement North America’s position as by far the weakest region for a UK investor.

A strong finish to the year resulted in an excellent 2025 for UK equities, with the FTSE All-Share index gaining 24.0%. Large, internationally focused companies led the way, with notable strength in the financials, mining, defence and pharmaceutical sectors.

Performance Chart

Pricing Spread: Bid-Bid Data Frequency: Daily Currency: Pounds Sterling

Calendar Year Performance Table

| Name | 2025 | 2024 | 2023 | 2022 | 2021 |

|

TSE All Share TR in GB |

24.02 | 9.47 | 7.92 | 0.34 | 18.32 |

|

TSE All World ex UK TR in GB |

13.82 | 19.61 | 15.38 | -8.25 | 19.53 |

Pricing Spread: Bid-Bid Performance Growth Option: Annualised Currency: Pounds Sterling

Within fixed income markets, government bonds were restrained by fiscal sustainability concerns, but UK gilts still managed a 2025 return of 5.0%. Healthy corporate finances and improved sentiment towards emerging markets saw superior market returns for corporate bonds (6.9%), high yield bonds (8.1%) and emerging market debt (14.3%).

The UK commercial property market slowed in the fourth quarter as Budget uncertainty impacted investor sentiment and activity. However, robust occupier demand and continued rental growth supported valuations, and alongside solid income levels helped deliver an estimated 2025 total return of 5.5%. Overseas real estate and infrastructure markets have seen underlying growth before the impact of currency moves.

Market Outlook

We expect another busy year of policy announcements and actions from the US administration ahead of the November mid-term elections, and are mindful that there are, as always, a number of risks that could cause market volatility, but the underlying fundamental investment environment remains a positive one for investment assets as we enter 2026.

The current key risks are trade policies, government fiscal sustainability, geopolitical conflicts, inflation returning and the risks of AI-related overvaluation, but for now these all seem manageable. Significantly higher US trade tariffs and the increasing fragmentation of the global trading system remains a concern, but tariff risks have eased somewhat as agreements have been made, trade has adapted relatively well to their introduction, and their impact is now seen as less negative than initially feared.

Heightened geopolitical risks and ongoing conflicts are still a potential cause for concern, but markets have continued to show a welcome resilience to recent flare-ups.

President Trump continues to dominate the headlines with his unconventional policies and leadership style, and markets dislike uncertainty, but history shows it is important for investors to stay focused on the key fundamental investment drivers such as growth, inflation, interest rates and valuations. Although investors have concerns over policies such as tariffs, immigration, the US budget and threats to central bank independence, they still broadly welcome Trump’s pro-growth policies of tax cuts and deregulation.

Elevated government debt levels and ongoing budget deficits in countries such as the US, UK and France remains a challenge, and bond markets may demand higher yields if debts aren’t seen as sufficiently under control. However, in a difficult political environment the latest UK Budget gave some reassurance to investors, and yields have settled down. Despite these debt challenges, many countries are delivering fiscal stimulus to support growth, most notably in Germany with their significant spending on defence and infrastructure.

Inflation and interest rates remain key factors for investment assets, and although inflation remains modestly above target in some countries such as the UK, it has made good progress, and the central outlook is for inflation to remain relatively subdued. This has given confidence to many central banks to cut interest rates in recent years, and although countries are at different stages of their rate cutting cycles, we are expecting further cuts in key countries such as the US and the UK. Whilst threats to the Chair and independence of the US Federal Reserve have unnerved investors, President Trump will get to appoint a new Chair in 2026 who will likely be open to even lower rates.

Barring an unexpected negative shock, 2026 looks set to be another year of resilient global economic growth of around 3% led by emerging market economies. Growth will be supported by fiscal and monetary stimulus and also from continued significant investment in building out the infrastructure for artificial intelligence. It is likely to be another big year for AI, although investors will be looking for evidence that a range of companies are increasingly adopting AI and are seeing efficiency gains and profits from doing so. This will be important to justify the significant investment that has been going into AI infrastructure and the high valuations that many of these AI-related companies have seen.

In terms of investment opportunities, the baseline remains the low-risk option that cash savings income can provide. This can be useful alongside other investment assets, but the UK bank rate has seen a further reduction to 3.75% and could move nearer to 3% in coming quarters. UK citizens tend to have an above average exposure to cash compared to investments, but cash returns are unlikely to match the medium to long-term return potential available elsewhere, so it is important for investors to get the right balance of assets to suit their risk appetite.

Valuations are also important for investors, and for fixed income assets their prospects are much improved following the welcome increase in yields from the previous exceptionally low levels. Whilst the period of increasing yields was painful for the returns of existing investors in many fixed income assets, the current backdrop of higher starting yields, subdued inflation and falling interest rates is more conducive to positive returns. Renewed concerns over government debt levels or signs that inflation was returning could impact government bonds, but with 10-year UK government bonds (gilts) yielding around 4.5% and at a premium to other developed countries facing similar issues, it is considered that these risks are priced in and they provide useful balance in mixed asset portfolios. Other fixed income options such as investment grade corporate bonds, high yield and emerging market debt offer higher income to compensate for their greater potential risk. Corporate finances overall are in good shape and default risks remain relatively low, so whilst the additional yields over gilts (known as spreads) are very narrow by historic standards, the overall yields of around 5-8% offer investors some attractive levels of income.

Equity markets have navigated the multiple challenges seen in recent years remarkably well, with many hitting all-time highs as they benefit from corporate profits growth, lower interest rates and structural growth opportunities from developments in areas like technology, healthcare and greater defence and infrastructure spending. Large technology and especially AI-related companies have been a key driver of markets in recent years, and that favoured the dominant US equity market, but last year saw a welcome market leadership rotation towards other markets and sectors such as banks, defence and mining. After such a strong run for equities, it is not surprising that some areas are now looking more fully valued, but with double-digit earnings growth expected for 2026, most equity valuations still look reasonable by historic standards. AI has the potential to be a significant development for markets and evidence of widespread and successful AI adoption would be supportive, with benefits moving beyond the AI technology companies. Equities remain prone to periods of higher volatility compared to other asset classes, but they have a long-term track record of success, and we retain our conviction in their ability to offer reasonable longer-term income and growth potential for patient investors.

Within equities, the US retains many structural advantages such as a large domestic economy, superior growth, cheap energy, a vibrant financial ecosystem, and its innovation and corporate leadership in key areas like technology. However, following a strong run of US equity market outperformance and dollar strength in recent years, elevated valuations, recent political developments and events such as China’s emergence as a credible technology competitor in areas like AI and electric vehicles and Germany’s fiscal stimulus have seen investors reconsidering the US exceptionalism narrative and looking to broaden investment exposures away from their previous heavy reliance on the US. Whilst we retain a large position in US equities, we continue to look to diversify exposures towards other more attractively valued equity markets such as those in Europe, Japan and emerging markets which also have their own strengths.

The previous structural headwinds for UK equities such as significant outflows from institutional and private investors are diminishing, valuation and dividend income levels remain attractive compared to other markets, and this is recognised by ongoing takeover interest from overseas buyers and private equity. Whilst the UK market lacks technology companies and has a relatively subdued domestic economy, it has a number of quality multinational companies in other sectors, and as investors reassess their heavy reliance on the US market, there is the potential for sentiment to continue turning towards markets such as the UK.

Within our private assets, UK commercial property market fundamentals continue to be broadly positive, but stronger activity and performance remain linked to further interest rate cuts and lower bond yields. Valuations are expected to continue to be supported by resilient occupational markets and rental growth in most sectors. Total return forecasts for 2026 and beyond suggest potential total annual returns of around 7-8%, with income contributing significantly to performance. Overseas real estate and infrastructure continue to be steadily introduced to relevant portfolios, with the expectation that they will also provide additional diversified sources of returns.

In conclusion, whilst we are likely to see ongoing elevated background noise and challenging headlines, the fundamental investment backdrop looks set to see another year of solid global economic and corporate growth, subdued inflation, lower interest rates and fiscal stimulus. Despite some fiscal sustainability concerns the overall valuation appeal of fixed income assets remains reasonable, and they provide useful attributes in mixed asset portfolios. Pockets of the equity markets are looking fully valued after a strong run and the exciting potential of AI will need to be delivered to justify valuations in that key area, but the longer-term attraction of equities remain intact and valuations especially outside of the US are still decent given the healthy corporate earnings outlook. Overall, whilst we are mindful of the risks, we remain constructive on investment markets as we enter 2026. We will continue to look to manage the risks by building diversified portfolios across different asset classes, sectors and geographies, and investors should remain focused on the longer-term attractions of staying invested.

Paul Glover

Chief Investment Manager

January 2026

Please remember that past performance is not a reliable indicator of future results.

The value of investments and the level of income received from them can fall as well as rise, and is not guaranteed.

You may not get back the amount of your original investment.