Are you being too cautious?

The increase in interest rates in recent years has been a welcome boost for savers after years of very low returns on cash savings, with rates of around 5% now widely available on instant access accounts.

Cash savings accounts play an important role when it comes to planning your finances. We all need a buffer to help us deal with those unexpected expenses, whether it’s an expensive car repair, a broken boiler or a period between jobs.

A cash savings account can also be a good option for money you know you’ll need within the next five years, such as funding a house move or helping family members with university costs.

With higher interest rates, leaving more of your money in cash savings can seem like a ‘risk free’ option, below we look at some of the pros and cons.

Inflation - the long-term risk

One of the greatest threats to the value of our savings is inflation, the rise in the price of goods and services. If the rise in prices is higher than the interest we receive on our savings, the buying power or real value of our money falls.

Over short periods the effect of inflation is often overlooked, but over longer periods it can have a big impact on the value of our savings.

Over the last ten years, (1st April 2014 to 1st April 2024), UK inflation as measured by the Retail Price Index (RPI) has increased by 50.5%, during that same period £25,000 invested in an instant access account (according to Moneyfacts) has grown by 7.89%. In terms of the buying power this represents a fall of 28.2%.

What are the alternatives?

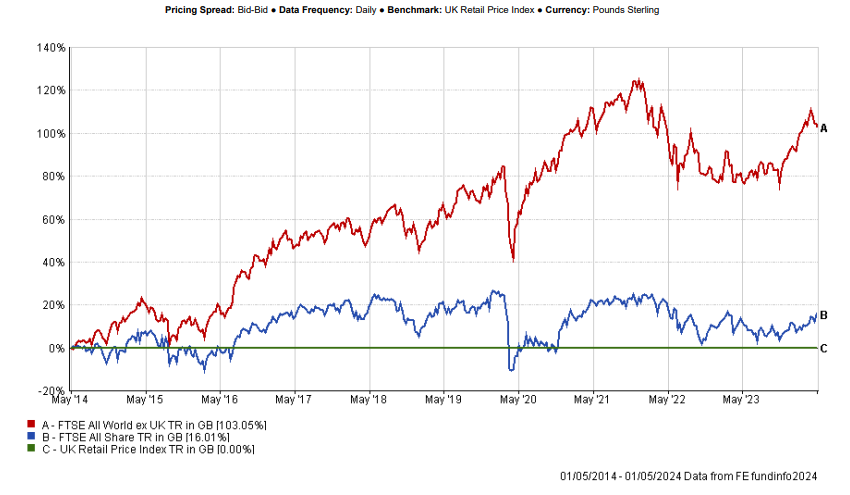

For money you’re confident you won’t need over the next five years, it’s worth considering the potential offered by share based investments. The chart below shows how returns from the UK and World share markets have performed over the past ten years after taking into account the effects of inflation (RPI). The returns also include reinvested income.

| 30/4/23 to 30/4/24 | 30/4/22 to 30/4/23 | 30/4/21 to 30/4/22 | 30/4/20 to 30/4/21 | 30/4/19 to 30/4/20 | |

| FTSE World | 18.1 | 1.7 | 4.0 | 33.3 | -1.0 |

| FTSE All Share | 7.5 | 6.0 | 8.7 | 26.0 | -16.7 |

Past performance is not a guide to future returns.

The value of investments can rise or fall and you may get back less than invested.

Getting the right investment for you

One of the downsides of investing is the daily ups and downs of the markets and the impact this can have on the value of your investment. For this reason, it’s important to take a longer-term view and give your investments time to work to harness the potential for real growth.

There are a wide range of investment funds available, catering for different risk appetites.

What next?

If you would like to open an investment, you can give us a call on:

0800 622 323

The value of investments and any income from them can rise or fall and you may get back less than invested.

NFU Mutual Financial Advisers advise on NFU Mutual products and selected products from other providers. When you contact us, we'll explain the advice services we offer and the charges.

Financial advice is provided by NFU Mutual Select Investments Limited.

Looking for financial advice?

If you’re not sure how to put your financial plan in place, one of our NFU Mutual Financial Advisers can help. They'll be able to recommend products that are right for you based upon your personal circumstances. You can book an appointment with an NFU Mutual Financial Adviser by either calling: 0800 622 323 or requesting a call back.