Article

What is paid ad spoofing?

How to spot a car insurance scam before you report a claim.

When you've been involved in a car accident and you’re in a hurry to get in touch with your insurer, you need the reassurance of speaking with NFU Mutual when reporting your claim.

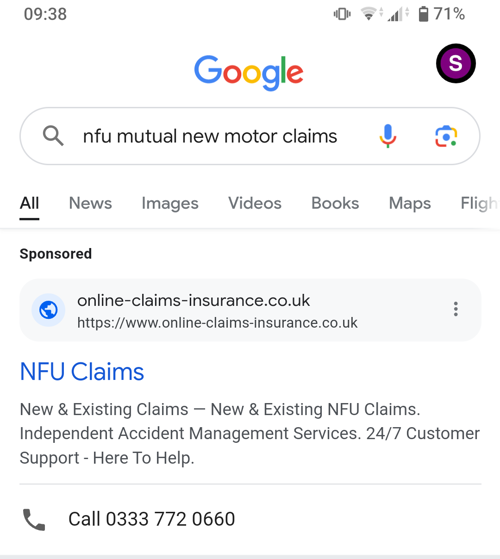

Paid ad spoofing is where other businesses pay for an advert to appear at the top of the search engine results page, often giving the incorrect impression that they are the company you are searching for. The below example shows a paid advert mimicking NFU Mutual and how it appears on Google.

These adverts look legitimate, but if you click on one of the ads from your phone, it may automatically call the number. Because you don’t see the website behind the number, you might not realise you’re not talking to your insurance company. These businesses pretend to be legitimate companies and specifically look to take advantage of those who have recently been involved in a car accident and are looking to report their claim. Customers are led to believe they are dealing with their insurer, but they are dealing with someone entirely different.

The number for NFU Mutual motor claims is:

0808 282 652 - 24 hours a day, 7 days a week.

To avoid being misled, follow our tips to ensure that you are actually speaking to us:

- Be cautious of paid search results - companies often pay search engines like Google to appear as adverts at the top of the search engine results page based on your search. Paid search ads have the title ‘Sponsored’.

- Verify the company - motorists will often call the number they've found on Google and assume it is their insurer. Please note that it has been reported to us that if you ask them who they are, these companies will tell you they are NFU Mutual when they are not.

We want to ensure that our customers are aware of the risks of these ad spoofing scams and understand how to avoid unintentionally contacting these fraudulent firms.

What happens to personal information if a spoofed ad is clicked on?

Companies who serve paid spoof ads sell personal information to a fraudulent Claims Management Company (CMC). This is a business that offers claims management services and often provide services like advice on claims, hire cars, vehicle recovery and repair and assistance making a personal injury claim.

These companies can arrange to have your car towed and provide a rental car. You might think your insurer is covering these costs, but you could end up footing the bill yourself.

What's the impact?

When CMCs provide a service, all costs they incur are in your name and, unfortunately, many drivers are being held responsible for thousands of pounds of unrecoverable costs. This can lead to the CMC’s issuing civil litigation against you even if you are not at fault for the accident.

Some costs can include:

- Parking and speeding tickets: CMCs sometimes don't handle these tickets properly, leaving drivers liable for the fines.

- Excessive car hire costs: the at-fault driver in an accident is only responsible for reasonable costs. The CMC will often make unreasonable claims in your name, and the hire cost will be disputed. You could be responsible for any element of the hire bill that the CMC can't recover from the at-fault driver's insurer.

- Legal implications: all losses covered by a CMC are in your name, so this gives the CMC a legal right to recover these costs from you directly.

- Denial of insurance coverage: CMCs might prevent you from using the insurance you've paid for.

- Data privacy concerns: your name, address, date of birth and other personal details have been stored by the CMC, and they may sell this data on to other parties.

- Warranty issues: CMCs might use repair shops that don't maintain the same standards as your insurer, potentially voiding your car's warranty.

Knowing what to look out for is key

Check the website of the firm you're contacting - the URL (website address) may give you a clue, but some companies use 'NFU' or 'NFUM' within their URL to try to trick you. Our correct URL is:

www.nfumutual.co.uk

This is our home page - if the Google link doesn't take you to an NFU Mutual URL, it will not be legitimate.

Double-check: If you're unsure about who you're speaking to, hang up and check your policy documents or our website for details about how to make a claim.

The best way to protect yourself from ad spoofing scams is to ensure that you’ve saved your insurer’s phone number in your mobile phone.